Governments, regulators, shareholders, and others are making advancements in the push to net zero emissions, and they are expecting the same from companies. What do net zero pledges mean for a company and its strategic future? How should boards be thinking about these commitments? What is the board’s role in overseeing those decisions and monitoring progress? Here, we provide the tools for directors to lead what’s next on climate change.

The climate change landscape

Some immediately think about global warming when the topic of climate change comes up. That’s certainly part of it, but climate change also leads to droughts, water scarcity, rising sea levels, flooding, and so much more. And the effects of climate change will have wide-ranging impacts on human health, the ability to produce food, and where people live and work. The future of humanity is dependent on addressing climate change, making it an urgent crisis.

The largest (though not the only) contributor to climate change is greenhouse gas emissions. Scientists estimate that greenhouse gas emissions must be reduced by half in less than 10 years to avoid the most devastating impacts of irreversible climate change.

US government’s perspective

That urgency is spurring various stakeholders, including the US government, to action. In the past year, the Biden administration rejoined the Paris Agreement, hosted a Climate Summit, and released a climate finance plan. President Biden also set a target for the US, the number two emitter of greenhouse gas emissions, to reach net zero emissions by 2050 with an interim goal of reducing US greenhouse gas emissions by about 50% of 2005 levels by 2030.

Biden administration action on climate change

- President Biden’s Executive Order on climate-related financial risks put into motion a number of self reviews by various government agencies

- In October 2021, the Biden administration called climate change a threat to the stability of the US financial system and outlined the plans for federal agencies to manage and mitigate financial risks from climate change

- A detailed spending framework, which includes ESG spend, was part of his approved infrastructure bill

Shareholders’ perspective

Many shareholders have heightened their focus on climate change. Specifically, institutional investors see the potential impact of climate change on the financial performance of companies in their investment portfolio, and are calling on companies to take action. Some have said they will use their proxy voting power against management and boards that fail to take the necessary action to address climate change, and in a few well-publicized cases, some of those actions have already taken place. Examples of the expected action include demonstrating how climate-related risks are considered and integrated into the company’s strategy and disclosing a business plan aligned with limiting global warming. Support for shareholder proposals focused on environmental issues, including climate-related actions or reporting, continues to gain momentum.

Proxy advisory firms’ perspective

The proxy advisors are also changing their voting recommendation policies in response to climate-related concerns. Institutional Shareholder Services (ISS) says it will recommend votes in favor of proposals seeking more disclosure on the financial, physical, or regulatory risks a company faces related to climate change on its operations and investments, or on how the company identifies, measures, and manages such risks. ISS will also recommend voting for proposals calling for the reduction of greenhouse gas emissions. It also said that it will evaluate “say on climate” shareholder proposals on a case-by-case basis. Glass Lewis has also adopted climate-related voting guidelines.

Regulatory perspective

The SEC expects companies to include financially material climate-related risks and opportunities as part of their regular filings. Sharpening that focus, in September 2021, the SEC’s Division of Corporation Finance reiterated the importance of interpretive guidance provided by the SEC in 2010 and published examples of staff comments the Division expected to issue to companies regarding climate-related disclosures. Companies and stakeholders await new SEC climate-related rules, which are expected to be issued early 2022.

As the broader climate change and sustainability discussion gains momentum, a number of companies have homed in on emissions and made net zero greenhouse gas commitments as well. Nearly 300 global companies have pledged to reach net zero before 2050, though their level of progress and planning toward reaching that goal varies significantly.

With those factors in play, and climate change weighing on the minds of many customers, suppliers, employees, and other stakeholders, now is the time for boards to consider how best to oversee the current and emerging requirements.

SEC Chair Gensler’s view on what mandatory climate-related disclosures might include

- Qualitative disclosures, such as how the company’s leadership manages climate-related risks and opportunities and how those factors feed into the company’s strategy

- Quantitative disclosures, such as metrics related to greenhouse gas emissions, financial impacts of climate change, and progress toward climate-related goals, potentially differentiated based on industry

- Scenario analyses on how a business may change to deal with future physical, legal, market, and economic changes

- Physical risks associated with climate change

- Transition risks associated with stated commitments by companies or requirements from jurisdictions

- Companies’ performance against their stated net zero emissions goals

- Data or metrics that describe companies’ performance against commitments, such as the Paris Agreement

What is the board’s role?

Strong governance is critical to ensure accountability for net zero is driven throughout the organization, starting from the top. Net zero commitments should be incorporated into the company’s strategy, and directors need to ensure that it is as part of their oversight responsibilities.

Going from a net zero goal to an achievable strategy is not simple. The task of actually achieving net zero or other climate pledges can be strenuous, and there is no one-size-fits-all approach. An effective net zero strategy combines a number of actions, including efforts to (1) reduce energy across the value chain, (2) make use of renewable energy, and/or (3) remove residuals through investments in sustainable projects. But questions arise as to what each of the actions really means and what their implications are.

What does net zero mean from a practical and operational standpoint?

Net zero is relatively easy to commit to, but quite complex to implement. Organizations marching towards net zero will have to take responsibility for tackling emissions everywhere in their operations, including at their suppliers and in their products, services, and investments. Companies should recognize that net zero likely requires a reshaping of corporate strategy, impacting their operating model. The allocation of funding for skills development, innovation, and R&D is one indicator of the importance management is placing on new capabilities, technologies, and business models—and companies are increasingly aiming these resources at achieving net zero.

Common net zero strategies

| 1. Reduce Energy | 2. Renewable Energy | 3. Remove residuals |

|

Reducing energy through capital projects and making infrastructure investments to improve efficiency, costs, and effectiveness of operations. Examples:

|

Switching to renewable energy sources. Examples:

|

Removing the residual emissions (after reducing and using renewable energy). Examples:

|

Note: If you are considering a carbon neutral* pledge rather than net zero, a wider set of offsets can be used and can balance emissions at any time. Offsets are only allowed as a last resort for net zero pledges.

*Carbon neutral means the release of carbon dioxide released equals the carbon dioxide removed from the atmosphere.

When thinking about net zero, companies will want to consider the applicability of setting science-based targets. Science-based targets provide companies with a defined path to future-proof growth by specifying how much and how quickly greenhouse gas emissions need to be reduced. Targets adopted by companies to reduce greenhouse gas emissions are considered “science-based” if they are in line with what the latest climate science says is necessary to meet the goals of the Paris Agreement—to limit global warming to well-below 2°C above pre-industrial levels and pursue efforts to limit warming to 1.5°C.

Greenhouse gas emissions

Greenhouse gas emissions are designated as Scope 1, 2, or 3, generally based on the level of control an organization has over them (see graphic below). Many pledges today are aimed at Scope 1 (direct) and Scope 2 (indirect energy related) emissions, avoiding the more complicated Scope 3 (indirect from activities that are not owned or controlled) category. Companies that have not yet embraced emissions reduction strategies or considered expanding their analysis to include Scope 3 emissions may find themselves behind their peers. Failing to publicly address reduction goals can expose companies to reputational risk or increased cost of capital, or even limit demand for shares. And there is the possibility that business partners may only work with companies similarly committed to reducing greenhouse gasses.

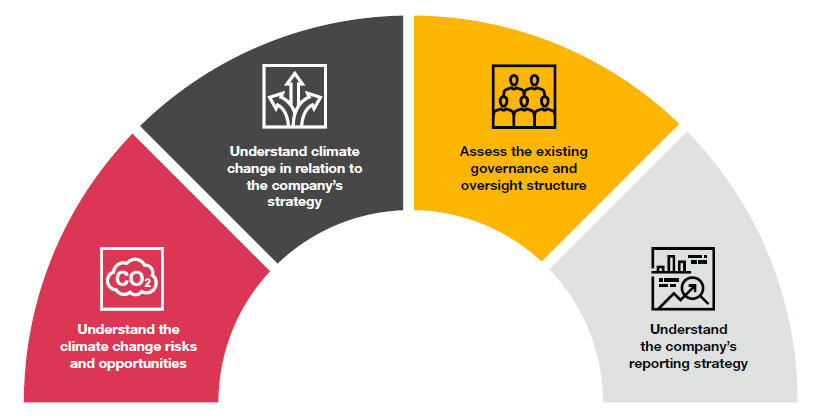

Within this current state of play, the board needs to be a part of any decision to make a pledge, understand what the pledge is, and once it’s made, monitor progress. As companies and the board work through this process, there are four core areas to think about: risks and opportunities, business strategy, governance structure, and its approach to reporting.

Four core areas of board oversight

-

Understand the climate change risks and opportunities

- Impact of physical, transition, and liability risks

- Integration into enterprise risk management (ERM)

- Opportunities and innovation

-

Understand climate change in relation to the company’s strategy

- Sector-specific trends and impact

- Competitor and industry landscape

- Emissions within the value chain

- Management leadership and accountability

- Management’s scenario planning

- Requirements to transition to low carbon economy

- Financing and investment needs

- Metrics, KPIs, and management incentives

- Key milestones and continuous assessment

-

Assess the existing governance and oversight structure

- Board or committee oversight responsibility

- Frequency and topics on board agenda

- Management reporting to board

- Board skills, experience, and access to experts

- Continuous education

-

Understand the company’s reporting strategy

- Voluntary and required disclosures

- Accountability and progress

- Data accuracy

- Systems, processes, and controls

- Own the narrative

- Reporting format (standalone, proxy statement, website)

- Value of assurance

1. Understand the climate change risks and opportunities

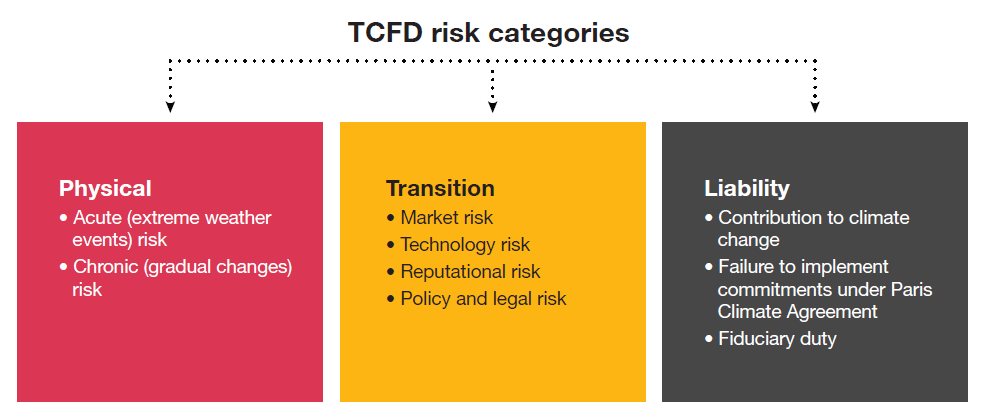

The Task Force on Climate-Related Financial Disclosures (TCFD) was established in December 2015. It’s stated mission is to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions. The TCFD separates climate change risk into three categories. Those are physical risks, transition risks, and liability risks.

Identifying risks into these categories and incorporating them into ERM can be an important first step. ERM integration can also help management put a plan in place to mitigate the risks. As part of this process, companies should be sure to assess not just the risk posed, but also opportunities for change and innovation.

The board may also want to consider the following:

- Which risks have management identified (physical, transitional, and liability)?

- Has management included climate change risks in its ERM? What are the plans to mitigate these risks?

- How has management assessed and prioritized the risks?

- Which climate change opportunities can be a catalyst for innovation?

- Has management considered the costs and benefits of investing in new processes and technologies?

2. Understand climate change in relation to the company’s strategy

Sixty-five percent (65%) of directors think climate change should influence strategy. Now is the time to work through the particulars of incorporating climate change into the company’s strategic goals—when the topic remains top of mind for investors focused on the long-term viability of their portfolio investments.

In particular, the board should understand the business impacts of transitioning to a low-carbon economy and be able to discuss the related strategy with management. To be effective, boards need an informed view of industry trends and what competitors are doing. They also need to know where the company and its supply chain emits carbon and emissions, any goals to cut those emissions, and the plan to reach those goals.

The board may also want to consider the following:

- Has management set a net zero vision that follows a science-based approach?

- Does management have the talent, technology, and processes in place to achieve its climate goals?

- Has management modeled the implications of climate change on operations and the related costs associated with decarbonization?

- Which strategies (reduce, renew, or remove) or combination of strategies does management plan to use to achieve its net zero commitments?

- Has management developed a strategy that improves its resilience to identified climate risks?

- What are the financing and investment costs needed to achieve the stated net zero target?

- What are the key milestones, metrics, and KPIs to monitor progress and measure success?

3. Assess the existing governance and oversight structure

The board needs the right governance structure in place to execute on its oversight of climate change implications. The board will need to assess who—a specific committee, the full board, or a mix of the two—should be responsible for overseeing climate change risks. Perhaps some strategic decisions and operations will be assigned to the full board for oversight, while other aspects are more easily delegated to a committee. For example, financial statement impacts could be overseen by the audit committee, while the measurement of progress against key metrics could be allocated to the compensation committee. For new items delegated to a committee, the committee charter should be updated.

The board may also want to consider the following:

- How often do ESG issues, and specifically climate change, appear on the board’s agenda?

- Who from management is (or should be) reporting to the board on the topic?

- Does the board have the necessary skills and knowledge to oversee climate change implications? If not, which experts or consultants does the board need to engage?

- How is the board continually educating itself on climate change developments?

The board’s understanding

Boards may not be fully up to speed on this complicated issue, but given its importance, they need to make sure they have the right educational opportunities or time with management to really understand the company’s commitments and how they will get there.

Only 25% of directors say their board has a strong understanding of ESG risks.

4. Understand the company’s reporting strategy

With disclosure comes the opportunity for a company to tell its story. Companies that have made a net zero or other emissions commitment will want to provide transparent and balanced reporting on how they are progressing towards their net zero ambitions, including business transformation and progress against KPIs (including actual emissions reductions achieved). This promotes accountability for transformation, drives progress, and informs relevant stakeholders, including investors.

Management should continue to monitor SEC developments (as discussed above). However, management should also pay close attention to global reporting developments. Even if they don’t directly apply to the company, these requirements could signal what to expect in the US. In April 2021, the European Commission published its proposal for a Corporate Sustainability Reporting Directive (CSRD). The proposal aims to set sustainability reporting on par with financial reporting by requiring reporting of group-wide sustainability information. Provisions would include: expanding the scope of sustainability reporting, making reporting a mandatory part of the management report, and requiring third-party assurance. The proposed CSRD also eliminates the ability to report required information in a separate report, making sustainability reporting part of the (consolidated) management report, and requiring monitoring by the audit committee.

For large companies, this reporting obligation will start for financial years beginning on or after January 1, 2023. These rules may apply to subsidiaries of US companies in EU member states.

The board may also want to consider the following:

- Has management performed a gap analysis between the information they want to disclose and the information they currently have available?

- What processes and controls are in place to ensure that the information being disclosed is accurate and reliable?

- Are different technology solutions needed to capture data and help track information?

- How do the company’s current disclosures compare to the information investors are asking for?

- How is the company communicating its efforts to reduce its environmental impact? What is the best medium to reach various stakeholders?

The TCFD can help identify areas of disclosure

The TCFD hopes to enable stakeholders to better understand the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risk.

The TCFD has issued 11 recommendations across four pillars: governance, strategy, risk management, and metrics and targets. Some institutional investors have already stated support for the broader adoption of this framework.

Conclusion

Public pressure is spurring companies to move from ambition to action. As companies set goals and put plans in place to achieve those targets, board oversight will be critical in ensuring that companies consider the risks and opportunities, and the right path forward. Missing targets or not making the committed progress could lead to reputational risk or the company could experience a reduction in available capital or declines in market valuation.

All boards should understand:

- What commitments has the organization made related to climate and if none have been made, why

- How the organization plans to meet its commitments or mitigate the risks of not having a position

- The procedures and controls governing the collection of climate data that will be used to monitor progress towards goals

- How the company’s long-term strategy is aligned with its commitments and/or the overall market trend towards a low-carbon economy

--

Republished with permission of the authors. This article originally appeared here.

This article was written by Maria Castañón Moats, Casey Herman, Paul DeNicola, Tracey-Lee Brown.